2022 tax brackets

Federal Income Tax Brackets 2022 The taxable income rate for single filers earning up to 10275 is 10 percent and for joint married filers is 10 percent tax on income up to 20550. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Tax Brackets Canada 2022 Filing Taxes

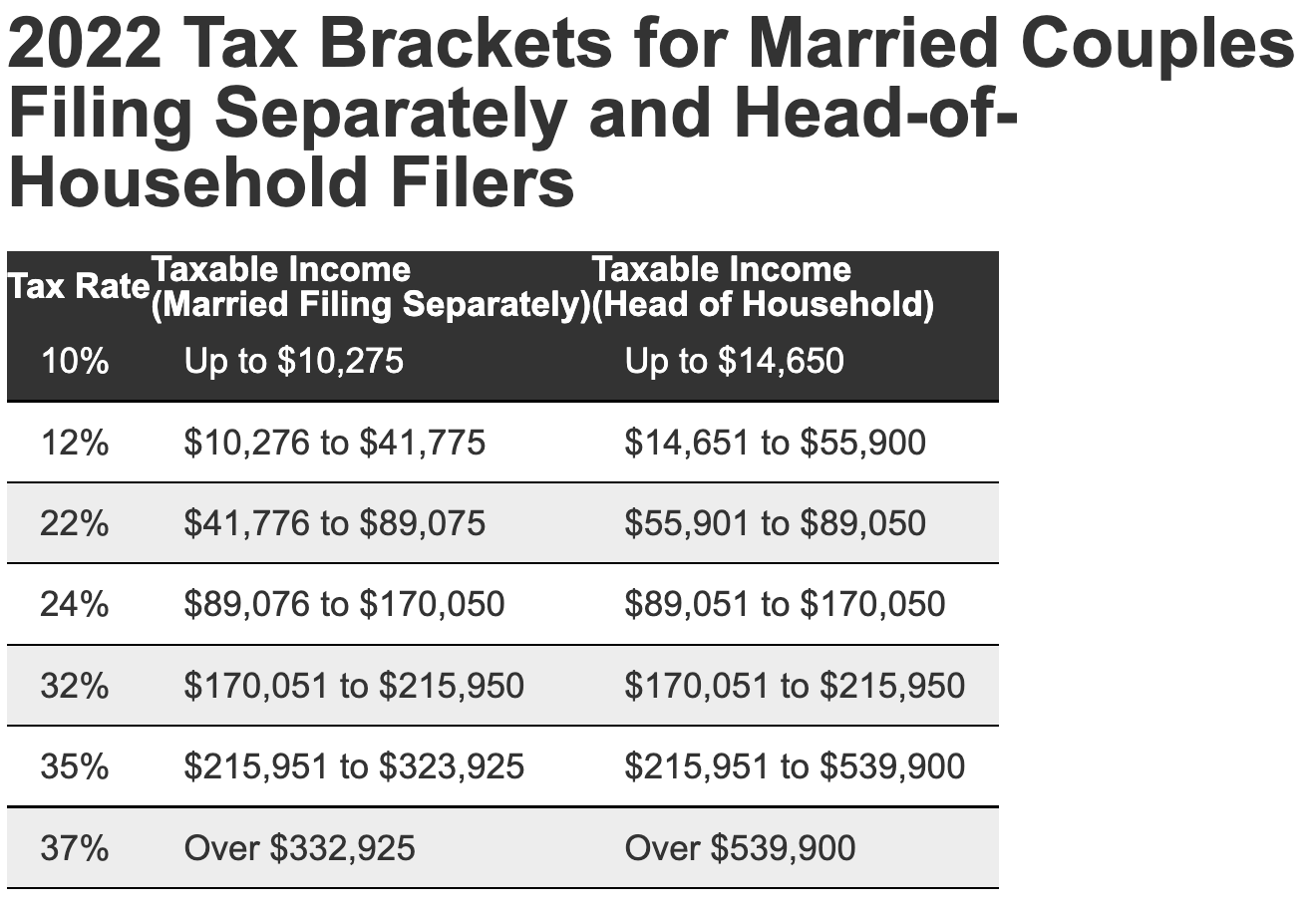

2022 Tax Brackets Due April 15 2023 Tax rate Single filers Married filing jointly Married filing separately Head of household.

. Download the free 2022 tax bracket pdf. The federal income tax rates for 2022 did not change from 2021. Get help understanding 2022 tax rates and stay informed of tax changes that may affect you.

12 hours agoThe agency says that the Earned Income Tax Credit which is for taxpayers with three or more qualifying children will also rise from 6935 for tax year 2022 to 7430. Single filers may claim. 1 day agoThe IRS will exempt up to 1292 million from the estate tax up from 1206 million for people who died in 2022 an increase of 71.

Taxable income up to 10275. Taxable income between 89075 to 170050. Taxable income between 10275 to 41775.

There are seven federal income tax rates in 2022. 2022 tax brackets are here. 10 12 22 24 32 35 and 37 depending on the tax bracket.

35 for incomes over 215950 431900 for married couples filing jointly. Whether you are single a head of household married etc. 2022 Federal Income Tax Brackets and Rates In 2022 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1.

The federal tax brackets are broken down into seven 7 taxable income groups based on your federal filing statuses eg. For tax year 2022 the top tax rate remains 37 for individual single taxpayers with incomes greater than 539900 647850 for married couples filing jointly. Up from 25900 in 2022.

The other rates are. Trending News IRS sets its new tax brackets. Taxable income between 41775 to 89075.

Heres what filers need to know. 17 hours agoThe IRS has released higher federal tax brackets and standard deductions for 2023 to adjust for inflation.

What Are The Income Tax Brackets For 2022 Vs 2021

Bigger Paychecks In 2022 With Expanded Tax Bracket Ranges And A Larger Standard Deduction Aving To Invest

2021 And 2020 Inflation Adjusted Tax Rates And Income Brackets

Taxtips Ca Ontario 2021 2022 Personal Income Tax Rates

2022 Income Tax Brackets And The New Ideal Income

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

Nyc Property Tax Rates For 2022 23 Rosenberg Estis P C

Tax Brackets For 2021 And 2022 Ameriprise Financial

Hmrc Tax Rates And Allowances For 2022 23 Simmons Simmons

Uk Income Tax Rates And Bands 2022 23 Freeagent

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Tax Rate Changes Starting Now Initiative Chartered Accountants Financial Advisers

What S My 2022 Tax Bracket Green Retirement Inc

Taxtips Ca Canada S 2021 2022 Federal Personal Income Tax Rates

%20(1).jpg)

Crypto Tax Rates Complete Breakdown By Income Level 2022 Coinledger

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

Irs 2022 Tax Tables Deductions Exemptions Purposeful Finance